Hmm. Easy fix, you’d think?

I think so, and their US banking already has this facility, and offers multiple file formats.

Hopefully it’s already on the list, because I’d like to join when the account is fully featured, primarily for customer service reasons, although I know that doesn’t matter as much to a lot of people.

I’ve convinced several people to switch to Starling recently instead of Chase as they don’t support switching.

Starling supported it from the start ![]()

I don’t know why you would want to join just for the customer service but from my experience. That isn’t worth it.

I’m not saying the customer service isn’t good. It just. I have rarely contacted them because everything with chase has … Just worked.

But yeah. It is good service. Chat wait times are less than 2 mins 24/7 and phone lines are good too.

Nutmeg is here

So, pulled my salary from Starling and it has been paid into Chase as of today. It all makes more sense for my own circumstances as I’m now all in with Chase on my savings too.

My overall daily experience with Chase just keeps getting better. I’ve certainly not missed using Starling for everyday spending.

I’m tempted to do the same, not too sure yet.

I’ve always considered Chase to be more of a threat to Starling than Monzo, because I reckon the average Starling customer would feel how you do about it.

Monzo on the other hand, as someone who does like the product, would miss it, if I were to go all in on Chase. But then I really enjoy the Chase experience. Probably moreso than Monzo overall. But Monzo’s trends, man. I love Trends. Particularly the balance tab, and I’d really hate to lose it.

Hopefully Chase get their API out the door on time in March and Monzo are quick to adopt because that’ll make it an easy decision for me. I can have the best of both.

In March I’ll just transfer £500 over to retain the benefit, before I do my annual finance shake up on April. I’d like to continue using both to some degree, but have a stronger urge to go with Chase for direct debits and spending.

The latter part of 2022 were quite messed up for me. Between the issues I had with Monzo and Chase, I would up banking with just RBS for a while. Didn’t mind, but was quickly back with Monzo once the app was finally reliable again. Chase I’ve just not properly got back into again yet.

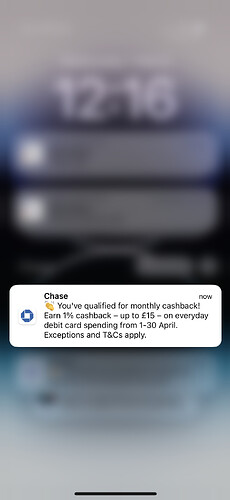

You get a nice well-explained notification once you’ve met the requirement to remain eligible for the cashback. A nice bit of polish I wasn’t expecting honestly.

Yes indeed. I felt all warm and that (especially as I’d previously pilloried them (not really) over their lack of warmth in comms.

Good signs…

Did it appear in a Flash? ![]()

I’d get me coat if I were you….![]()

![]()

Don’t think I’ve had one but I’ve deposited a decent chunk of change

From what I can see, the email notifications are being drip-fed.

You’ll only get one if your cashback offer expires this month. If it doesn’t, you’ve no minimum pay in requirement to meet just yet.

That will be my case for a few more months. I will qualify anyway as my salary is paid into chase but it’s nice how they are improving the communications.

I’m just looking forward to a credit card - not just for another card but to see how they implement their “rewarding banking” touch to it. Will it be Cashback. Will it be a points building card like their American brands. Whooo knowsss. I wish I knew someone that worked at Chase.

So my previous post above really got me thinking about Chase offering a credit card.

Surely - they offer 1% Cashback on all debit card spend. You wouldn’t want to spend on a credit card with them unless that offered the same.

Right now, with the new Cashback criteria you have to pay a certain income each month. They could make it so you either to be eligible for Cashback on Debit and Credit spend either pay in x amount each month or hold a credit card with them?

Who knows. Only time will tell.

I’ll be brutally honest, I don’t really care too much about benefits, just convenience.

I’ve been waiting patiently for Starling to launch a credit card, but it always seem like it will be “soon”

If Chase beat them to it, then I think it could be time to cut my ties with Starling.

I closed my Personal Starling Account. Still have my business account. I reckon Chase will 100% beat Starling.

When Starling become the only one without a credit card they might change their position and bring a credit card offering ![]()

It’s just occurred to me that even Monzo have beaten Starling to the credit card game. Not a proper credit card mind, but still. Did anyone ever anticipate that?

What’s with all the heel dragging going at Starling, I wonder?

It’s been coming soon for far longer than either Monzo or Chase had ever planned one.

Not an easy game to make money from any more - 15 years ago there was a killing to be made but enforced tightening of lending criteria, PPI disappearing and finally the interchange fee cap have killed basically any significant revenue, other than interest and fees. There’s also a greater expectation in terms of cashback or rewards.

Mind you, current accounts are also famously not exactly money spinners…