All is good. ![]()

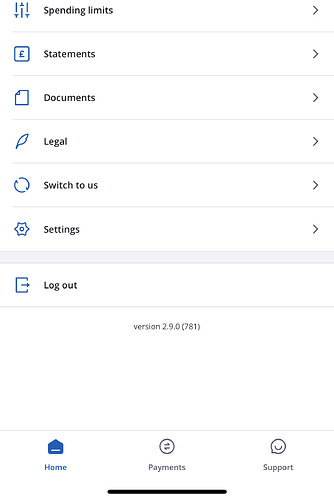

The Chase website now confirms 1% is being earned on current account balances, and version 2.6.0 of the iOS app also shows this.

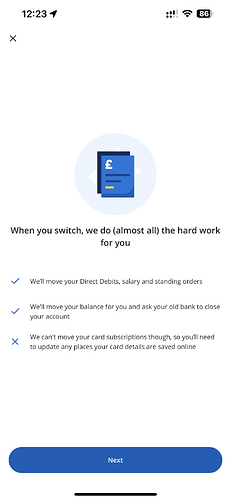

Does membership of the CASS system work in both directions (so to speak)?

It should, but Chase’s setup might complicate things. I couldn’t even fathom a guess as to how switching out of chase via CASS would work. It’s too unique of an approach that goes against established paradigms.

Someone on Monzo said you have to close all your accounts and keep one open before you’re able to switch. It’s hearsay though, I think. Or second hand from someone somewhere else.

I’ll reach out to Chase and ask later.

I was kinda hoping you’d be able to switch just one of your Chase accounts, leaving the rest open. Would make a very attractive place for setting up switching fodder on the fly.

Sounds consistent with their ‘we don’t want you back if you leave’ thing (which is totally understandable). Let us know what you find out.

That’d be very convenient, but I’m not sure why Chase would encourage that sort of thing.

So you get switching bonuses from others and then stick with Chase

Guessing it’s pretty much an automated process these days and they spin up accounts like it’s nothing so the actual process can’t be extremely expensive

Will do!

Would it really be encouraging it just through it existing and being possible? I used RBS to spin up dummy accounts for all the switching bribes recently, which worked fine. I suspect you can do similar with other banks as well, it’s just not always convenient or quick to open additional accounts. Chase would be no different other than having the benefit of the process being very convenient and near instantaneous, which is just its fintech spin on things.

I do this with Halifax and Lloyds al the time. You can have up to 5 current accounts from each at a time.

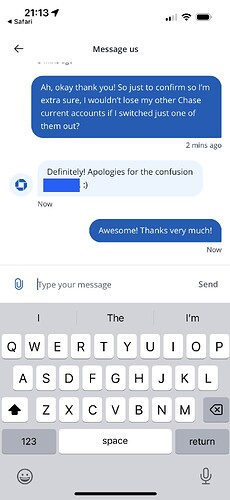

I’ve spoken to chase.

Then I double checked they understood my query properly. Then I double checked the answer they gave was correct. Then I triple checked.

If you have multiple Chase current accounts and switch one of them out, so long as you still have at least one current account still with Chase, you will keep your chase account and all your current accounts and savings accounts. So yes, you can create and use them for switching fodder.

However, if you only have one Chase current account and you CASS it away. You will lose your entire Chase account and wind up in the same position as @JIMMWX. Even if you have 10 savings accounts. It all goes.

Also, that was a very pleasant customer service experience. Replies were prompt, checked to make sure they were right, apologised when they made an error the first time around, and handled my probably somewhat bizarre query very well.

Wow! That is a real boon for serial switchers in that case, thanks for doing the discovery.

I think the only thing you’d be best off avoiding is switching your “default” Chase account.

For some reason I closed that by mistake last year as I was clearing up the many current accounts I had opened in the app and remained with only two.

To my surprise that initial first account I opened is the one that is reported to Transunion, no additional accounts.

Also something that makes surprised is how other institutions treat the Chase accounts. I have two scenarios with Ford Money and Paypal. These two only allow funding from your linked/nominated bank account but with Chase, I send money from any of my accounts even savings and it always gets credited. If I try to move money from my other banks to Ford Money or Paypal it gets returned.

Is this something specific to Chase?

Never tried it from any of my other accounts.

I have two linked to Zopa. Let’s see what happens when I try sending to Zopa from an unlinked Chase Savings account.

Update: Promptly (within two minutes) returned by Zopa as deposit not from a linked account.

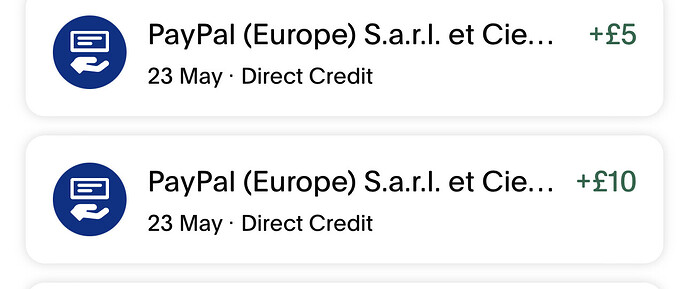

Let me try again today with a tenner to Paypal

Update: I have sent to Paypal from two unlinked Chase accounts. Both have been credited. Does Zopa require you to use a specific ref number?

Reference number, no. Deposit from an account number registered with them, yes.

Could this be the reason? As for Ford Money and Paypal you have a specific reference number to use. May be with that the system only checks name on account sending. I don’t know.

I am waiting for Ford money to confirm the £10 I have sent from an unlinked account (round up), transaction shows complete in Chase app.

This has been returned this time because it wasn’t sent from nominated account.

https://reddit.com/r/UKPersonalFinance/comments/13pkipb/chase_have_now_implemented_open_banking/

Chase have now implemented open banking

Just received this email from MoneyHub informing me that Chase have now implemented open banking, and connections can now be made through the MoneyHub app.

We are thrilled to announce that Moneyhub now offers Chase as an open banking connection.

A lot of you have been (ahem) chasing us for the availability of this connection and we have worked closely with Chase this year to get this up and running.

This currently will only work on mobile devices and you will need to ensure that you have the Chase banking app already installed to establish the connection.

After a few attempts (received a connection issue message multiple times), I managed to finally get the connection made.

I assume other alternatives to MoneyHub will follow suit.