I wish they’d extend the 5.1% rate to all accounts. This just encourages more admin for them, I open more accounts and then dump it temporarily into a single one while the others sit active ?

I don’t even get one at 5.1%, and I have been there since day one launch in UK ![]()

I don’t understand why there are different savings rates applying here. ![]()

They gave customers who weren’t using the savings accounts a 1% bonus to encourage them to use them.

The criteria for how they determined those users is a bit flawed, but it’s not terribly different to the sorts of things other banks have done in the past to get folks using their account.

'tis odd I agree but I think it was alluded to earlier in the thread about enticing regular customers such as myself who moved their entire savings out of Chase several months back, to redeposit some of that cash. I had moved everything to Tandem. A few weeks back, Chase offered me the new boosted rate, so I moved most of my savings out of Tandem back into Chase boosted savings. Between Chase and Barclays Rainy Day Saver at 5.2%, I’m getting a reasonable amount of interest on all of my instant access savings.

My Wife incidentally who also uses her Chase account for most of her regular banking, hasn’t been offered the boosted rate because she didn’t move any of her savings out of Chase.

As always, disloyalty pays.

True. I’m not overly concerned though tbf as my savings are in three accounts at 5.20% atm, and a 5.08% ISA ![]()

And that’s the bit I don’t quite get.

Kinda does ![]()

Unfortunately in this instance I wasn’t disloyal enough. Wonder if it’s worth moving my bills account to Starling an the offchance that I get an offer from Chase later ![]()

Thing is for me, once the Chase booster rate comes to an end, if Tandem as an example offer a higher rate, it’s fairly obvious I’ll just move it all back to Tandem. If Chase want me to keep my money in their savings account, they need to compete with the likes of Tandem just as they are now, not for just a few months.

I use Chase as my main personal account, it’s a breath of fresh air over Starling in my own worthless opinion but I’m always looking at other providers. I’ve never been particularly loyal to any bank, after all, they’re a business, they exist to hopefully make money from their customers.

Yep - all that ![]() , (though I retain a liking for Starling as the repository for my huge monthly income……

, (though I retain a liking for Starling as the repository for my huge monthly income…… ![]() )

)

Alas that will never happen as, like Kroo current, Chase are moving their savings account interest to a tracker style, as opposed to competitive rates.

Here was me thinking you’d blown it all on a yacht to go with your fancy private bank debit card

Blew most of it - it’s a medium sized yacht ![]() . I find big yachts rather ostentatious, don’t you?

. I find big yachts rather ostentatious, don’t you? ![]()

I don’t want a yacht, I just want Chase to give us dark mode ![]()

It’s unlikely Chase are seeking the business of rate tarts. As noted above this will be more about drawing existing users, possibly those who just use the account for cashback, further in to the Chase ecosystem.

5.1% with strings attached is strong but not unbeatable already.

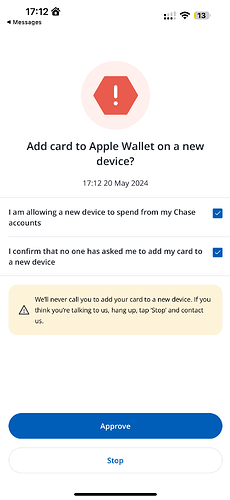

This is first time I am seeing such a step when adding card to Apple Wallet.

I haven’t seen it with any other bank yet.

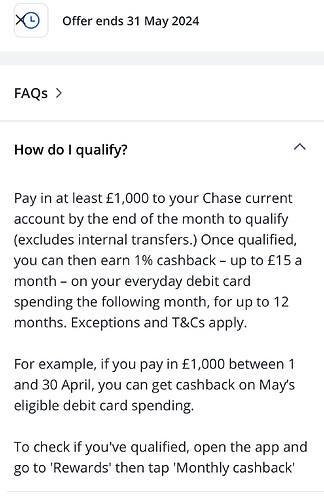

Is Chase ending the 1% cashback offer? They forced me to update the app today and when I goto rewards it now says the offer expires 31 May 2024

There is now a qualification requirement to be able to get cash back the following mont. You have to pay in £1500.

Emails were sent out about this.