Samsung Pay in Korea is different to Samsung Pay in Britain, in that it will work with MST as well, so I don’t really want to bounce between Google/Samsung Pay depending on the country

In that case, you’ll need to switch to another bank or card who supports Samsung Pay or stick with iPhone. The Curve workaround folks keep touting to make Triodos usable might help here whilst keeping Chase?

I will be taking my iPhone, so I might use my iPhone majority of the time for payments and use the Samsung via UnionPay when I can’t use Chase I guess.

Something I’m really surprised about is that while Chase can link to Alipay/WeChat Pay, there’s no integration between Alipay/WeChat Pay into Apple Wallet. They do integrate into Samsung Pay/Huawei Pay/Vivo Pay et al though

Today’s base rate cut means that the recent boosted Chase Saver will go from 5.1% to 4.85% next Thursday.

I genuinely thought that if you were on the boosted rate, you stayed on it until it expired. My bad I misunderstood ![]()

We have the extra 1% until that expires. The underlying rate, though……![]()

Chase is going to go even lower.

From 8 October 2024, the AER on our Chase saver account will change from 1.15% to 1.25% below the Bank of England base rate.

Aye, annoying but not world-ending. Regardless of this change, for us it’ll change soon from being the account which holds everything easy access to being the account which drip feeds everything else (to pay in to regular savers, make payments in to Santander 123 in time to cover DDs etc, cover account fees), topped up once a month from something else (likely Ulster as things stand).

Yes, it seems Chase’s role will change in the coming months.

I may be missing something, but their email notification today speaks of two boosted offers, one ending in November, the other in January. In my case it’s November.

Aye, there was a targeted booster, ending in November, then an open one anyone could grab, ending in Jan. There was a window you could swap from one to the other, but it has passed.

I see. In any case, the course is clear. ![]()

Gratefully still getting rates above 5.20% elsewhere atm.

Chase could go one worse and stop allowing DD on saving accounts, so not all bad news…yet!

Chase have, for some time, been purely a savings vehicle for me so it’s an orderly retreat for me.

![]() I didn’t realise that was possible! I’ll get all my non-cashback earning DDs moved over.

I didn’t realise that was possible! I’ll get all my non-cashback earning DDs moved over.

Yeah, I’ve used one purely for Energy and pay the “recommended monthly payment” into that, and then pay my monthly bill from it via variable DD.

The surplus is then in MY account earning ME interest, not that of the provider.

Every now and then I review the balance and usage and move any surplus to higher interest paying account elsewhere. £1,000 currently sat in Santander Edge Saver at 7% ![]()

Also have one purely for credit card DDs, but the returns are not so great as don’t really use my credit cards much.

That wouldn’t be nice at all. I’d be relocating the DDs to the Coventry if they pulled that one. Or perhaps the CoOp Pathfinder, though that might be the same thing a year or two down the road.

Or maybe back to Starling.

They made a big deal about locking their rate to 1.15% below BoE and they’re changing it already!

I only recently moved my savings to Chase, annoying I have to find somewhere else to move it again so soon!

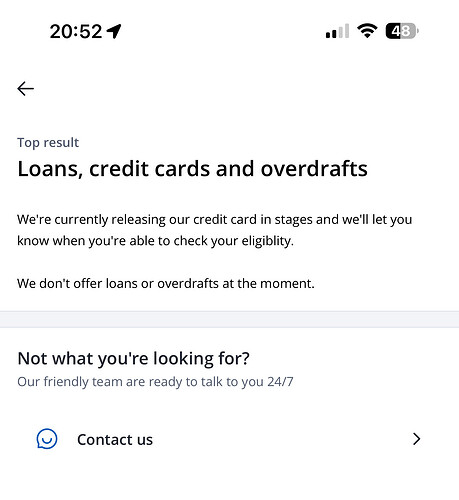

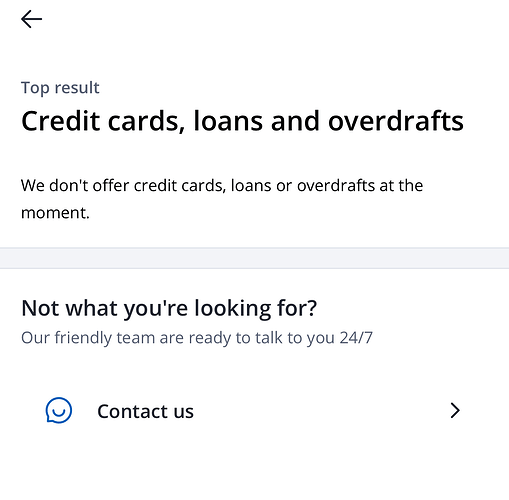

Good news, I have high hopes for this - if they can afford 1% cashback on a current account then that has to be the baseline for their credit card, IMHO.