Can you pay it from a new Chase current account then CASS that out?

It’s not a direct debit or standing order within Chase so that won’t work.

I pay it from chase boosted saver, minimum payment automatically each month.

Yes - i just don’t get why this repayment method is quite so bespoke.

Probably to keep you all in with Chase. Monzo Flex is the same.

Good chance, but it’s daft. Maybe it’s a throwback to US bank consumer thinking. Either way, it’s a deal-breaker for me.

I’ve got a really healthy credit limit with them and I’d use it well. Instead, I use a Santander card with a lower but useable limit.

A pity……

I haven’t even been offered their credit card, possibly because my account is dormant with just £1 in it.

Mine is maxed out and no longer used. Santander binned as 12 months up.

I use them as my main bank and haven’t got the offer either.

Got declined several times. Been offered a Nationwide one with decent limit and balance transfer offer on top of the purchases offer.

I still haven’t been offered the Chase credit card either so I gave up waiting and recently opened the Nationwide credit card with 15 months 0% interest.

I use the account extensively and have yet to be offered it. Same with the Zopa card until very recently. There is obviously a profile I don’t fit.

Haven’t been offered the Chase card either, but I have no UK spending for over a year so I’m not really surprised.

Thinking about moving away anyways, cashback is over. The boosted saver I’ll keep until it dies but even Revolut has a better base rate for normal customers as it stands.

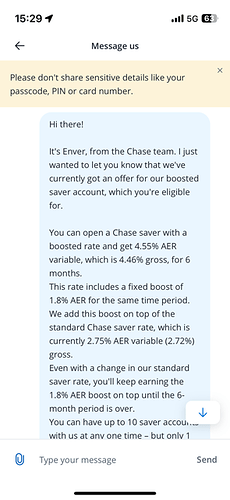

They’re seeming a bit desperate for me to bring my savings back, now advertising it via a chat message.

I’ve not been offered their credit card but was emailed the saving offer.

Since the interest and cashback has been scaled back, I stopped regular credits and left a token balance in the current account. Probably won’t use it again until I want US Chase ATM access.

I too have kinda killed my Chase usage. Going to move banking closer to home - the building society based in my hometown will give me a fair share to maintain my account and pay my bills. Why would I be interested in getting nothing but a decent interest rate to stay with Chase (that doesn’t really require me to do anything other than park the money).

Chase told to pay £150 to neurodivergent customer because app didn’t have dark mode

If dark mode was so important to her, why didn’t she just switch to a bank that provided it?

She’s still in the same position now, with no dark mode, so she’ll either have to manage without it, or change banks, which she could have done ages ago.

To be fair, I genuinely don’t understand why Chase UK don’t introduce dark mode, it’s something I too have complained about to customers services but it’s just something that clearly isn’t important to them.

I already use banks with dark mode, RBS and LHV. Indeed I use dark mode everywhere I can. I just find it easier on the eyes. If Chase would like to give me £150, they know where I am ![]()

The actual ombudsman ruling:

Personally, I think Mrs C should just ditch and switch.

Surely customers cannot tell companies how to design or run their apps or systems.

This could be the thin end of the wedge.

I am all for accessibility to all, however, this example pushes it imo.

Or perhaps I don’t complain enough about things I don’t like, rather than just use alternatives.