@anon22494410 @Joe @MikeZ @Cookies Reassuring to know I’m not alone! May I ask when you joined the waitlist?

I received the email after joining the waitlist on the 21st @ 9.39am, so a few minutes before then I guess.

Ah ok, a similar time to me then. I wonder what methodology they’re using for clearing the waitlist. It’s certainly not chronological…

Thanks. Just done it

Edit: Got carried away and need to top Chase up again

Early afternoon on Tuesday.

9.35am Tuesday. No code yet.

I’m in

It does seem to be loosely chronological.

Why I say that is, I think all of us who signed up the night before the actual launch (so Monday evening, late) did get an invite by the end of yesterday afternoon.

But then there are also examples of them clearly picking people for an invite “out of order”, so who knows what’s going on?!

Quarter to 12 Tuesday

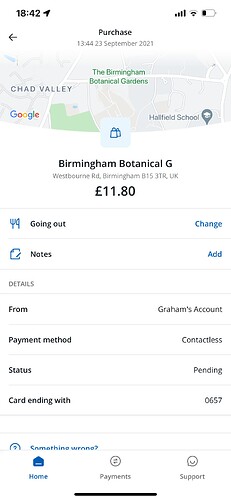

OK: so having had my accounts blocked by RBS and being made to go to the branch to show my ID and get everything unblock today - this evening I decided to move another £500 to Chase…

You guested it - RBS blocked my account AGAIN and the fraud team phoned me… exact same line of questioning, though this time it was simpler because when I asked me why I was making the payment I replied, Because RBS are rubbish and I want to move all my money to Chase.

Anyway they have now unblocked it - I guess I should count myself lucky the didn’t make go to a branch again…

I’d get the wheels of a CASS in motion tonight! Makes me nervous about moving money through my own NatWest account. I’ve had fairly large sums moving through it before for very time sensitive bills and they didn’t block anything then thank god, but perhaps I should count myself lucky!

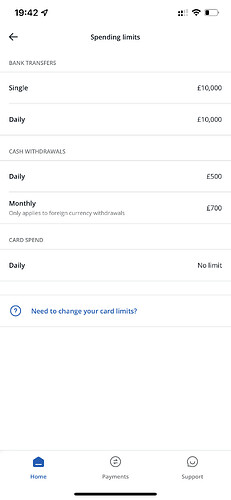

Anyone know the daily ATM limit for Chase? I’m assuming it’s more Starling (and basically every other UK bank) than Monzo in that regard…?

And I wonder if there’s a daily card spend limit as well? Monzo and Starling differ from the traditional big banks in that they have a daily £10k limit on debit card transactions, whereas the high street banks have no set limit, subject to fraud checks.

Sorry, it was meant a bit tongue in cheek

That monthly part is a bit confusing.

Do they mean £500 a day, every day, in the U.K. (with no monthly limit) but a presumably rolling 30 day (or maybe calendar month) limit only if abroad for fair-use?

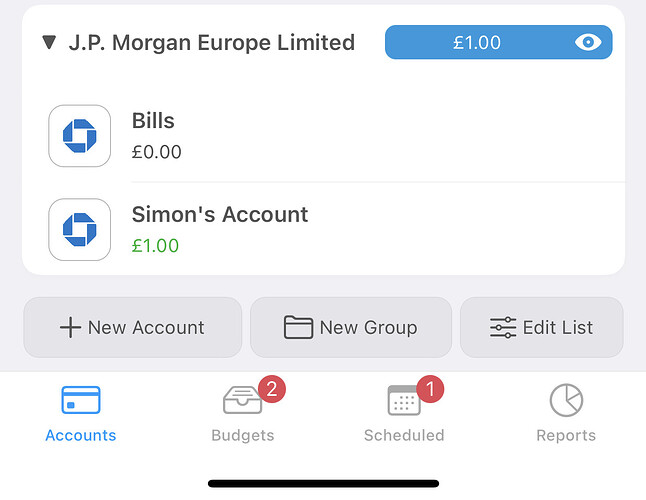

I just noticed you can switch what account the card is tied to, that’s interesting

Yes, so you could have a “holiday” account and switch to that while you were away.

The shortcoming is, any regular bills paid by card would then end up going out of that account too (if taken during the time it was selected).

They need to figure out some logic for those situations. It could be either another set of card details per account, in addition to the numberless card, or some clever logic to be able to make subscriptions as “always pay from x account”.