iOS but im new to it , can you force stop on there ?

The Planned Work screen is incredibly annoying when it pops up every single time you open the map.

Something like that should really be cached and remembered

Yeah, getting through the CS chat was painful with it popping up between every screen…

There’s still a use for my credit card then ![]()

After asking if anyone had got their card yet, mine arrived today.

Quite impressed with it tbh

Now, all I have to do is try and get over my affinity to Monese and Revolut and give it a proper try out.

Just to update you guys, my invite code finally arrived at 11.30 this morning! It took them over an hour to verify my details, which seemed a lot longer than many others have experienced, and that combined with the vague ‘please head to the app now for an update’ SMS gave me a bit of a fright that they’d rejected me but nope, application approved and I’m in! ![]()

First impressions: the app feels very barebones compared to Monzo and Starling, as you’d expect at this stage, but I really like the colour scheme and overall UI. There are a lot of fintech features that I do find myself missing, which I’ll be sure to pass on to them via live chat since I expect the team to be especially receptive to feedback at the moment. I find the knowledge that there’s a 24/7 customer support line that actually isn’t crap really reassuring personally. I’m looking forward to receiving my physical card in the post next week!

I contacted their CS this evening requesting they add a “known by” name to their records; while my full name is Robert I’m known as Rob by everyone. They did just that. It took about 15 minutes and was handled very efficiently, professionally, but friendly in tone.

A much better experience than I’ve ever received from the drones working in the Starling CS team. That said, I guess Chase isn’t that busy just yet.

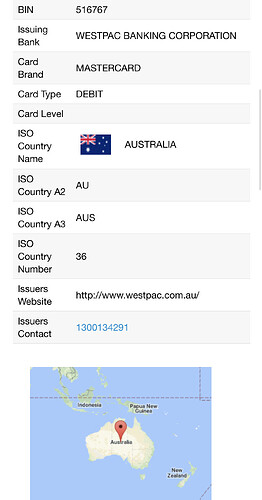

Just looked up my Chase virtual card BIN to see what Mastercard tier the card was - I saw @Seb mention on the Monzo forum that the physical card must be World Elite since it has the silver MC logo, which is a fun bit of trivia I didn’t know, and I was wondering whether the virtual card was World Elite too - and it came back as WestPac Australia… ![]()

I guess JPM must’ve acquired the BIN off them for Chase UK (if that’s how those things work?!).

Still waiting for my actual physical card. No sign of the postie today, which is par for the course (my local delivery office is seemingly constantly understaffed so we often don’t get deliveries every day). Hopefully Monday…

The Chase soft search is showing already in my CreditKarma app as JPMorgan Chase Bank anti-money laundering. Before launch I had concerns that, as the child of such a large traditional bank, Chase UK might hard credit check applicants and reject based upon poor credit, so it’s nice to see them being fintech-y and inclusive and only AML soft-searching people. They didn’t ask for any salary/income amount details either, unlike all UK high street banks. They did ask for employment status and source of income however, which I can’t say I remember Starling and Monzo asking for? (May we’ll be wrong though, I joined a few years ago now!)

I wonder whether they’ll now rebrand their offices around the UK as JPMorgan and Chase (i.e. display both logos), since that could certainly help with brand recognition, especially with their Canary Wharf building.

So, I had to ring them back and re give all my application questions over the phone

They seemed particularly focussed on my email, asking if it’s personal and how long I’ve had it for?

All a bit legacy, better than an auto decline I guess but still.

It went out to an overseas call centre and then back in to someone else who sounded UK based

I don’t think the ‘neo banks’ have a great deal to be quaking in their boots about currently, but that may change

It could be because, effectively, this is not a current account at the moment, more akin to Monzo’s pre-paid account prior to their launch of a current account, imo.

They don’t offer overdrafts yet (credit), they don’t offer DDs yet (current account function).

I wonder if hard searches may be required should they later offer overdrafts, and consumers apply to use them? Would make sense to me if they then performed a hard search, as they would be providing a credit facility, and need to ensure the risk level is appropriate to each consumer.

I mean, Starling offer overdrafts but still don’t hard search you when you apply for an account. I’ve never applied for an overdraft with them but I assume they hard search you when you request an overdraft in the app?

Yes, they offered me an overdraft when I opened my Starling account so I took it. A hard search appeared on my Transunion record but not the other two CRAs.

Just had a look and it’s still there. Transunion keep them for two years, it appears.

Mine too

My region is set to United Kingdom.