Not what it says in their Appdate

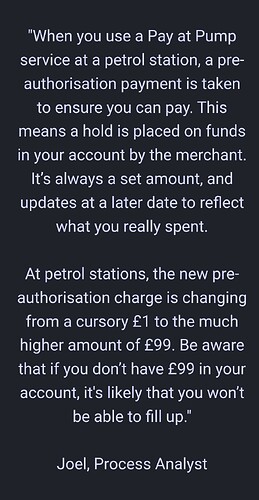

When I read this Pay at Pump update from Mastercard about 3 months ago and contacted Mastercard in a tweet they said if funds lower than £100 amount pre-authorised will take max of available funds and you won’t be able to fill more than that amount.

Notifications now seem to be causing a vibration/sound when they come through with the latest update instead of being silent

Now we just need to add the option for noise

Did you feel a vibration then?

Are you on iOS?

Yes I’m on iOS I noticed my phone vibrate as it was on silent when a 3ds notification come through

Okay maybe is just for that then, because I didn’t notice anything different when I received a transfer to my Chase account.

I have the latest update so I will give it another try and see what happens.

Just made a transfer to Chase Account - no vibration or sound here either.

Me too - nothing - there was me getting my hopes up!

My card arrived today and asked me to activate it in-app. The app asked me if I had the card on me and I said Yes. Is this because it does something clever or is it just to ensure that I’ve actually received the card before I activate it?

Perhaps I should have said No to see what it did…

Presumably, it just won’t allow you to go through the activation process until you confirm you’ve received the card.

Yes, it was just the wording that it used - not “have you received it” but “do you have it with you”. I found that slightly unusual.

I’m sure I saw someone mention that they had to tap their android phone on the card? Presumably this step is missing on iOS because Apple locks the NFC chip down on iPhones but the wording is still there

What would you do if your Android phone doesn’t have NFC? They still sell phones without it.

I didn’t, I just had to confirm I had received the card. My phone does support NFC.

Yes, Monzo does (but also allows you to, optionally, enable Face ID as an option instead). They would argue that it is still 2 factor as factor 1 would be “inherence” (using the app on a registered secured device) and factor 2 is either knowledge or something you are (Face ID or the card PIN that, supposedly, only you would know).

The way Chase do it, as you so clearly say, is basically more clunky but for no extra security benefit - it’s only just as secure, if not slightly less secure, than Monzo but far more awkward and you have to (potentially) type your passcode twice!

I knew we’d pique your interest eventually!

Agreed!

That does seem like a major (and unique) feature.

Yes, they’ve got to get their skates on and make the product compelling aside from the cashback within that time.

A tall order, given they’ve set a time limit, but possible.

Some version of cashback or rewards probably also has to remain as otherwise most people will have little incentive to continue using it.

Yes, it’s called a “partial authorisation”.

The partial authorisation process was developed by the card networks precisely because they wanted to switch to charging people the value of what they’d just filled up immediately, but couldn’t rely on everyone having £100 available.

I think Joel from Starling is probably just mistaken @Breezy.

True, although as we’ve seen with other fintechs, if an idea is good the big four will copy it, but if the cashback isn’t viable long term they won’t want to.

A handful of peanuts in the form of a few pence cashback here and there isn’t enough to make it worth even opening the account. If that makes me sound like a supermodel who won’t get out of bed for less than a certain fee, well so be it.

For me it starts and ends with customer service. But that isn’t just about answering the phone quickly. That’s the cherry on top nowadays, but there has to be a full cake there underneath, meaning a fully featured app, online banking access, Direct Debit, a credit card which appears on the same app, and the ability to download transactions.

In other words, the direction of travel Starling are now taking, now that they’re maturing into a profit-making business with a long-term future. Which is making themselves look more like a big four bank which as a new starter they originally wanted to differentiate themselves from, except without the legacy tech, systems, payroll etc.

And, my interest in the account has already waned significantly. I haven’t received the debit card yet as I only opened the account on Thursday so that is to be expected.

I used the account on Saturday for the first time, to pay for shopping in Tesco on Pay+, trouble was, I had forgotten to enable cashback, but it was only £7 anyway, so I’m not crying lol!

Another reason I opened the account, was to see if I could actually get another account after only being in my new house for 3 months. I am on the Electoral Roll, trouble is, only one credit reference agency is reporting that I live here. The others firmly state I am not on the Electoral Roll when I am, so it just goes to show how crap they actually are. I’m not submitting a notice of correction because I’m not applying for any loans or credit elsewhere.

Quite honestly, unless Chase do something fairly significant with the account in the coming months, it’ll just become a fairly pointless account. My overall impression is, someone from the Chase banking group should have sat down and looked at Starling and thought, we need to do better than that from the off. It’s a bit of a fail as it stands. If anyone from Chase should be reading this, you need to feed this back and get them to pull their fingers out. As things stand, Starling for me is quite simply the best banking account I’ve ever had.