Unless I’m missing something (and if I am please correct me) but the 1% cashback is still no match for my Amex Avios.

Now if I were to get the cashback for paying my Amex with Chase that would be different (hint hint)

It came at a time my subscriptions were due to be paid, I pushed broadband, mobile, Amazon through this card. I now also started using it for Petrol and probably anything that qualifies. My credit cards are getting a break for a year.

I am stacking it up with the 1% I get from some retailers on Curve so some will go up to 2% back to me. One of them is Amazon and BP. I am now buying Amazon gift cards (shop there often for my little ones) of value X.01 to send random 99p to my round up account

My airtime rewards transactions take minimum 10 days to track on whatever card I use, I will have to wait to see them get tracked

I’m still waiting for an email as to why their Android App isn’t available to me. As predicted here, when I originally queried it, I was told I “needed at least 8.1 to run this app”.

Er, I have Android 10.

Since then, silence.

Yes. Lightbulb moment for me - just revived my mothballed Curve card. ![]()

I’m seeing how long I can go without touching it. A nice side effect of a coin jar this size is that it acts as an interest-free overdraft buffer.

While earning a ground breaking 0.05% interest. Still. A grand effort.

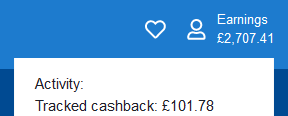

If I had not touched my Top Cashback, I’d have over £1334 in there.

Sadly, it currently stands at £0.39 payable ![]()

Just topped my Iceland Bonus card with £17.01 and £3.01 using Chase.

£1 bonus added by Iceland

£1.98 roundups in Chase.

Could move loads of money into 5% savings that way, but cba tbh

Was just curious after seeing a post elsewhere by someone doing similar with amazon gift cards

I thought Iceland gives you £1 for every £20 you save. Were you just topping up to make up the £20?

Random one, but any idea when direct debits will be available?

Yes. I do £20pm then just shop off the bonus card. Free quid every month that way

The money sloshing around this forum

That’s 5% back, way higher than any savings account around. I only wish it could be withdrawn as cash before I wake up from my dreams.

Just got my first statement for September

Me too. Even for my additional 19 accounts.

11 posts were merged into an existing topic: Switch Bonus

Hi all

It looks like the chat on switching has gathered pace - I’ve moved the conversation to a more suitable thread…

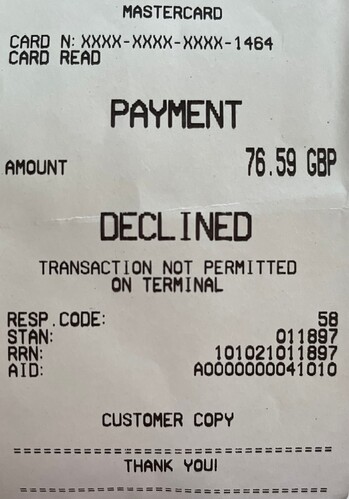

Had a curious experience last night paying for a meal in a restaurant using Apple Pay.

The bit that interested me was the response code 58 (transaction not permitted on terminal). After a quick google I found this.

Given the article I can only assume this is associated with the virtual card nature of the numberless Chase card. When I inserted the physical card the transaction went through just fine.

I have used Apple Pay numerous times previously at the restaurant albeit never with Chase. This is the only “interesting” experience I’ve had with Chase thus far.