I was terrified to even consider transferring money directly from FD just in case they blocked it because of no CoP, so I transferred from FD to Starling and then to Chase.

Least they are looking to bring in COP soon

How long did your Starling > Chase transfer take? I’ve just done a £5000 xfr and wondering how long to expect it to take.

Weird that if I’m recalling correctly, you can’t spend from it

Well mine was instant, but only because I pay into my Chase account a couple of times a month to fund the account and Starling obviously now recognise the transfers to Chase as ‘normal’.

My Wife on the other hand, attempted at first, to transfer £1k from her Starling account to her new Chase account. The transfer just kept ‘pending’. Eventually, she got a message from Starling saying that because she had not paid into the account before, she should try a lower amount, so she transferred £100 and it went through with the usual couple of minutes delay on Chase’s end. She then transferred £1k and it went through almost straight away.

This is the problem of Chase not being signed up to CoP. It would appear some banks have no issue and just let whatever amount you want to go through, subject of course to daily limits. Some banks however seem to actually care about whether you might be getting scammed, so take the extra precautions.

You can set up standing orders from your savings account to other Chase accounts and external payees. I’ve now done this successfully.

You can set up direct debits from your savings account. I’ve started that ball rolling to pay my American Express bill via this.

But you cannot link your debit card to a savings account.

Cheers. It went through after a couple of hours, presumably after Starling had reviewed it, without me needing to do anything.

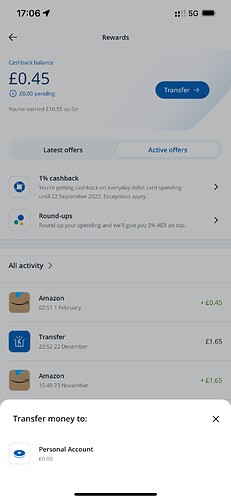

Also, rather strangely, you can’t withdraw cashback to your savings account.

How do you mean?

(I’m probably missing something).

Just moved £20k from Marcus to Chase.

If they complete the current account features and it could be all in.

The need do keep at the front with the monetary offerings and they can blow the others away, and with the resources they have they should do.

Lets see if they keep it up.

Absolutely. The Chase is on…… ![]() .

.

Ah I see. Thanks. ![]()

It’s not as simple as being a current account with a savings element, then.

Not sure of the thinking behind it, but hey ho - 1.5% is not to be sneezed at.

Given how much inflation has gone up - we were still better off earning minus 1% during the earlier part of the pandemic.

I’m starting to think that rate chasing is a mirage and I should make my emergency fund more proportionate to an actual emergency (smaller)

Either way - I don’t have my Chase account any more. I found it boring at the time - I suppose it’s a little more exciting now…

It depends on what you deem interesting.

I am there for the cashback and now the slightly higher interest rate and all work fine.

Also free FX transactions.

Cashback I find a counterintuitive feature for day to day debit card spending as it has a subconscious bias toward spend when the odds against you are only 1pc improved. I could see it being good value for a large purchase - but I’d probably revert to a credit card for that. Round up’s mess with budgets imo. Fx abroad I had covered by three other card issuers already.

That said - the savings account and their current marketing ramp up are probably going to hit the fintechs hard.

Would be good if they could kill the below at every sign-in, which persists even after you’ve already opened one. Distracting, so I may have to have a lie down.

I’m not seeing it on iOS.

I am, it’s there on my iphone XR. I’m not particularly bothered by it though, I just scroll down and it goes up and disappears ![]()

True, but you’re still now worse off not getting the extra interest ![]() Debatable whether the raw amounts will make any difference at all to most people…

Debatable whether the raw amounts will make any difference at all to most people…