Well I took the risk and transferred cash directly from my FD account to Chase and it all went through just fine. I’ve been busy emptying some of my current accounts into Chase savings because at least there, they will earn something. My Wife has gone full pelt and effectively just chucked the lot of her spare cash into her brand new Chase account.

Apart from the name of the Marcus which makes me smile because when I was a child, I had a hamster named Marcus, yes, I really did have a hamster named Marcus ![]() I wonder just how much money has been shifted out of Marcus to Chase in the last 48 hours? I really would love to see the figures.

I wonder just how much money has been shifted out of Marcus to Chase in the last 48 hours? I really would love to see the figures.

I only have a £1 in Marcus as held accounts with better rates elsewhere, so my transactions on Monday won’t feature in that total, on this occasion.

I would be interested to see how much moved from Virgin Money’s 1% accounts to Chase.

When I spoke with VM Fraud Team yesterday, yes they blocked my suspicious transactions, they confirmed that they have been really busy since Chase’s announcement on Monday.

I bet they have ![]() I bet there’s also been some sweat dripping brows there too.

I bet there’s also been some sweat dripping brows there too.

Is anyone have problems with opening new accounts within the app? I’m getting “you have reached your limit with us”, I have 8 accounts within the app, 4x normal accounts & 4x savings ![]() contacted CS and they say I can up to 20 accounts, that includes 10 savings accounts.

contacted CS and they say I can up to 20 accounts, that includes 10 savings accounts.

Nope.

I have 4x current and 6x savings + round ups ![]()

Android app

Yea true - but I think they’re just the first out of the gates - it’ll be available with standard savings products soon. Good to have it in house for those who like the current account though - no denying that.

That said, I’ll have invested a reasonable chunk as opposed to holding a large amount of cash soon.

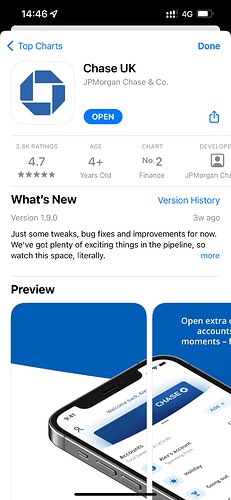

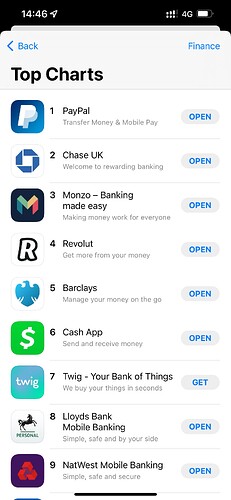

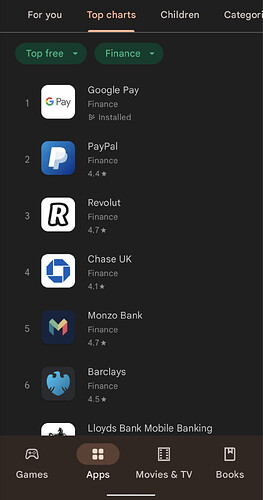

Looks like number 4, per your image.

Or is 59 All Apps, and 4, just Finance?

Yes 4 is just finance and 59 is all apps.

Just started the process of moving my banking from monzo to chase 1st step was to cancel premium!

I see from your post in the other place that you’re not going to bin your Monzo account but leave it dormant?

Not a dig at you personally, I get why you would wish to keep your options open, but I wonder if Monzo, or other banks for that matter, will eventually routinely get round to purging clearly dormant accounts. Then again if one reads the fawning about customer numbers on the Monzo forum, perhaps it isn’t in a banks interest to bin off customers that just leave their accounts with bugger all in them or clearly have stopped using them.

It’s a question of cost. Do the ancillary costs of keeping the account open outweigh the process cost of closing it? Then also the muddier value of keeping a customer onboard for future potential.

Consider also for bigger banks that a customer may have multiple accounts (savings etc), so closing one account in isolation may have virtually no impact on cost (because you still have to maintain the customer relationship anyway). Monzo is probably in a different boat…

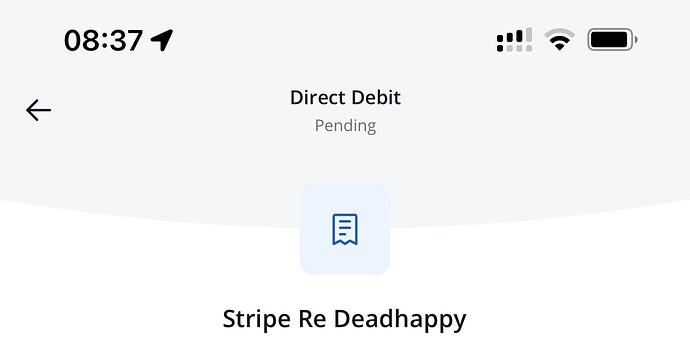

Just contacted support got a reply from a person in 30 secs regarding changing a name on a direct debit they are looking into getting it changed

Having closed off my chase account and not now being able to re-open it till next December (trust me, I already know that was a stooopid decision) If I were to “leave” Monzo again I’d just leave it dormant.

Yes, that’s probably good practice. The problem comes when you’re fed up with CS, it’s Sunday evening, you’ve got your phone out……![]()

![]()

And probably join the undisclosed numbers of dormant/unused accounts Monzo already probably have. But of course they have 5 million customers ![]()

In fairness I doubt that other banks don’t do this too

So the Wife is now Chasing me round the house with her brand new card ![]()

Not bad at all that, 3 days from opening the account and she’s completely up and running with her new account and she’s now chucked most of her spare cash in there too.