Is that not the same thing?

Don’t fall into that trap!

Impressed with customer service asked them if they can add Lidl logo and will be adding soon.

Apparently the bank of England will be increasing the base rate to 2% next year. Presumably others will be offering similar to Chase soon.

When I reported that my local corner shop was showing as “Select Fashion” rather than “Select Supermarket”, they corrected it within a day or so (and added the shop’s logo which only appears to be on their Facebook page as they have no other online presence).

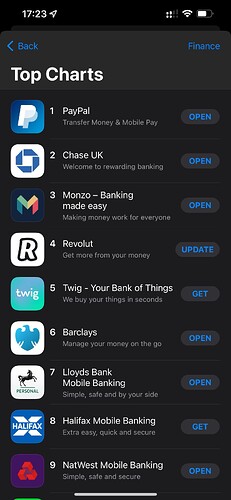

Hmm. Twig appear to be at number 5 due to a £4 refer a friend scheme.

Never heard of them ![]()

Are they app only, or do they have any branches?

I just see them on the beermoney subreddit. It’s second hand clothes/a prepaid card?

Perhaps evidence that this leaderboard isn’t particularly informative.

I see what you did there.

Could say, I twigged ![]()

I’d leaf it there, if I were you ![]()

A post was merged into an existing topic: Savings accounts recommendations

I’ve just blown the dust off my Starling account. Trouble is, the current Chase offering makes it very difficult for me to utilise Starling to any significant extent.

Chase isn’t exciting, and may never be. But it’s incentives are hard to ignore and it’s clearly carving a space for itself.

But I do like the old Starling thing……![]()

Oh that’s interesting, so you can then use this to add to Airtime Rewards or other apps that need the real card number.

I never thought I’d actually say this, but I’m seriously considering now dumping my Starling account. I’ve barely used it since I started with Chase and I’ve shifted almost my entire personal banking to Chase from across my 3 personal accounts. The likelihood is, it’ll just become dormant. It’ll be the same with my recently opened FD account. I’ve had my free £150, so I’ll stick with them for a year and get rid.

I’ve just a couple of direct debits coming out of Starling and my pension goes in every month and leaves the same day. Unless Starling can come up with something really tasty, then sadly, even though their debit card was great for overseas use, well that is now also covered by Chase anyway, we may be parting company in the next 12 months.

You’ve pretty much encapsulated where I’m at.

And regrettably, there isn’t, and nor has there been, any sense that innovation is important to them. The connected card during early COVID, was a great move.

Stable, solid, dependable - absolutely. And I don’t think they want to be anything else, certainly not edgy.

So it’s Chase’s race to lose.

Yup, mostly why I left them, felt like they had “gone stale” - not that I expect new features daily but nothing was particularly groundbreaking for me with Starling

I think going forward Starling see their offering more as a ‘banking as a service’ proposition to third parties rather than retail current accounts.A credit card was heavily mooted but never appeared and the current account offering is now stale, plus I’ve lost count of the number of logo improvements I submitted to no avail. We’ll just have to see where they end up in relation to the legacy banks and the rest of the new fintech, who have both eaten into the previously fairly exclusive features of an app only offering.

Has anyone been able to cash back on purchases made via Paypal? I mean direct purchases not direct debit.