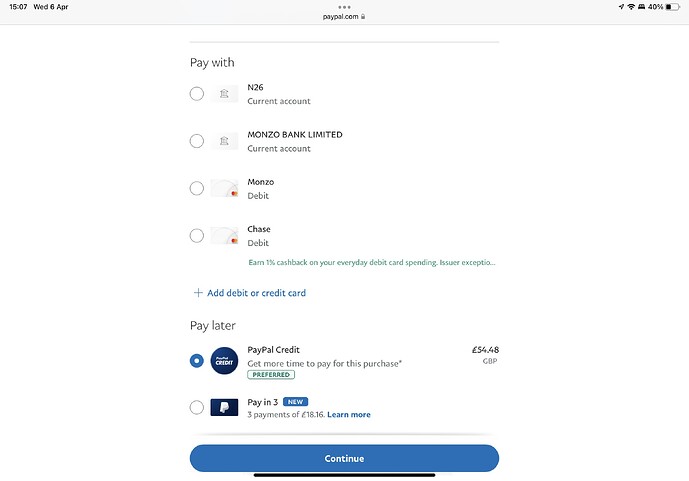

Yep. Even noticed lately, that when you check out with PayPal if your Chase debit card is saved in your PayPal wallet it get’s highlighted with a note that tells you you’ll earn cashback if you select that card.

This is interesting. Let me add it there too. I have been missing out.

Apart from the better savings rates (Chase) and the overdraft facility (Starling), is there really that much to set them apart?

They do feel very different. I guess the savings offering is the obvious pull and I don’t need an overdraft. I can only be assume that (or something like it) is just around the corner for Chase.

Much between them, otherwise? Maybe not, but I’m keen to see the differences in a year or so.

I have to admit, although it isn’t used an awful lot, I can’t quite bring myself to get rid of Starling (yet anyway)

I have no idea why, as I had little or no problem dumping Monzo when it wasn’t to my liking (too gimmicky for me)

Chase is only currently being used for the savings rate, as my reward credit cards offer better value (for me personally) than the 1% cashback for everyday spending.

It will be interesting to see how they evolve.

Starling’s app is much snappier than chase’s, which is slow and clunky, at least on android.

After using Starling for two months last year, I do not regret closing the account. It was not as exciting as the way it is hyped.

I’m not bothered about “exciting” - I just need something reliable that has all the functionality that I need, especially instant notifications. Starling fits the bill nicely, as does HSBC (if you regard around 20 seconds as instant).

Nearby payments is the one Starling feature that keeps me using the app.

Pretty much everything else I need is now done as well or better elsewhere (albeit with a slightly less fancy UI sometimes). The Euro account feature is probably their biggest USP now but it’s relatively niche.

I think Chase is good in this sense as they can spend thousands hiring people purely to update logos etc.

Things that are absolutely not needed but are really small things that draw retail customers

Don’t know the US market, but that whole logo thing maybe something they’ve already nailed.

Starling updated logos at the start…

Given that Starling provide a UK IBAN rather than EEA IBAN, it’s value as Euro account is limited for incoming SEPA payments. As a UK debit card, you’ll also be fighting against DCC even when linked to the Euro account too.

It’s good for a spare switching account ![]()

Is it fair to say that Starling just no longer bother doing this?

Something I would be grateful if Chase introduced. That along with dark mode and maybe cheque imaging at a push, though on the latter, cheque imaging only came into my life after doing my elderly neighbours weekly shop when they’d give me a cheque.

It seems so but I do notice some times logos removed or changed.

I rarely bother to look at my Starling app any more and if I’m honest, logos aren’t really important anyway in the grand scheme of things, well, they’re not that important to me, nice to look at, but not really essential. I submitted loads of logo improvements to Starling and they just did nothing to change them, so I stopped bothering.

One thing I have noticed of late with Chase though, is that payment/money transfer notifications, have significantly improved in terms of speed of receipt. They used to take a couple of minutes sometimes, but now it’s down to just a few seconds.

I will say this much, my overall experience with Chase has been far more superior over the last few months than with Starling, which has like others have stated, become rather stale and run of the mill. Ok, Chase doesn’t have an App to quite match Starling’s, but I’m sure it will improve. Chase is now by and far, my everyday banking account and unless they do something terrible, I’ll undoubtedly stick with them.

Yeah, I had a Spanish company tell me this week they can only send Euros within the EU. If I wanted it into a UK amount, they have to convert into GBP. No idea why and suspect it’s IBAN discrimination nonsense or just Spain being Spain, but it is a problem. Wise is still BE, but their fees and charges just give me a headache, so not ideal.

The Germans, Austrians and Romanians so far all still paying fine into Starling. ![]()

Can you not get them to pay into Wise, and then transfer on to Starling (still in Euros)? If I’m reading Wise pricing correctly, they would just charge a fixed 0.41€ fee for the transfer