Good point. On that basis, I’d be surprised if you’d be permitted to add to a boosted account with notice already given.

You had been. That was the loophole.

Gone in v 1.59.0 Android

Well spotted, that man ![]()

Ford Money have limped to 2.96% AER (monthly interest) or 3.00% AER (annual interest) wef today.

Second rise in 14 days, but still behind the pack.

The pack seems to mostly be settling on that 3%. A few edge above it, but they tend to lose flexibility in the process.

I’m pretty happy to go with one of the instant access savers at 3%. Got a few options now from Atom (not quite 3%), Chase, and Monzo.

Not gonna bother chasing a few extra decimals of a percentage point and give up the instant access. They’ve spoiled me. Even Marcus is too slow now.

How quick are the withdrawals from Ford?

Selling point for Ford is they’re open to those 16+! Most are 18+.

Disappointing given further raises to the BoE rate are a near certainty that they’re opening such a gap. -0.85% difference between BoE rate and ‘best buy easy access’ rate is huge.

No idea.

Put a £1 in (when at I think 2.47%), in case they ever became competitive, however, they didn’t.

My quid is still there ![]()

Presumably someone got fired - from a cannon, right through that enormous loophole.

Club Lloyds Monthly Saver up to 6.25% now, still max £400pcm in.

Non-Club up to 5.25%, still max £250pcm in

As Ford Money use a clearing bank (Barclays) this has some impacts on our transaction processing times.

If your withdrawal is requested before 1pm on a working day (Monday – Friday), your funds will reach your Nominated Account by close of business the same day. If the request is made after 1pm on any day, the funds will arrive in your Nominated Account by close of business the next working day (Monday – Friday, excluding public and seasonal holidays). Please see table below for further guidance:

You will always receive a text message notifying you of the withdrawal request on the processing day.

I appreciate it, thanks! A no go for me then.

The fintech interest rate wars have begun. Starling has decided not to take part ![]()

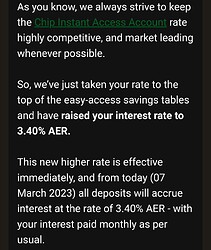

Chip was the leader at 3.15% and now it’s Tandem at 3.20%.

Zopa at 3.21% AER.

10%+ from providers and it would be worth thinking about given ‘truflation’.

As if… ![]()

It’s like being thrown a 30m rope when you’ve been pushed into a 100m+ well.

3.21% ![]()

I think they just want to be the top of the MSE top savings accounts as it’s changed twice just today.

Let em fight for it, I say! All the better for us in the long run.

A shame it’s just in .01% increments. Makes it barely worth paying attention to.

Yes, it’s all a tad marginal right now.

Discussing savings accounts with my mate last night. Oh how I laughed when he told me how he’d switched to a new HSBC ISA, giving him an “improved” rate of… 2.3%! ![]()

Wow - I moved my emergency fund to Chip at 3.05% and that was less than a month ago!

Gatehouse have increased their easy access expected profit rate to 3.20%, for anyone interested.

Effective today (17 March)