Anyone tried Starling on Android 12 yet? (And Monzo too)

Anyone else been asked for SA302s to up their overdraft?

Thought I’d chance a bit of an increase and have had quite the grilling for £250 extra that was on offer… To the point that I really wish I hadn’t bothered. I’ve never had any bank ask for my returns just for an overdraft. Plus, Starling has been my hub account for a while, so they can see the main part of my income and outgoings directly anyway.

Even Halifax that I rarely use offered me £500 out of nowhere with no extra checks just choosing the limit and accepting terms.

I’m assuming I’m somewhat out of touch here so please forgive me for my ignorance, but I take it then that overdrafts are pretty much de rigueur for most folks? I only say this because it seems from reading, that an awful lot of people rely hugely on an overdraft. I haven’t had any form of overdraft facility since 1996 and I’ve never been offered one on any of the multiple accounts I’ve had in the last 20 years. I’ve never even checked with Starling to see if I am eligible for an overdraft.

I’ve only had one overdraft in my life and that was when I open an HSBC account earlier this year. They offered me £1000 and pointed out that I had already been hard-searched so I went along with it. Never used it and switched away in the end.

Perhaps I’m fortunate never to have needed one.

I’ve found the overdraft on opening accounts to be pretty much hard wired into the application - “would you like an overdraft blah blah?”. Always say no, can’t recall an account when that wasn’t in there somewhere.

I must have had an overdraft when I first started banking, but that would have been round about the same time as I opened a Burton’s credit card, so that puts it in perspective ![]() .

.

You just reminded me that I had one of those, too. It was pretty essential for a dapper young gent ![]()

Good lord!

Do they still exist?

Not sure (not even sure if Burton’s exists now  ). My first suit (dapper as it happens

). My first suit (dapper as it happens  ) cost £60 made to measure.

) cost £60 made to measure.

At £5 pm minimum payment, I reckon it was one of the most expensive suits in Aldershot

I have an overdraft facility. I don’t usually use it but may go a little below zero some months if necessary. I never pay any fees though as I have enough in Goals to cover it. I wouldn’t use an overdraft that costs me to use it.

Snap! It’s just a convenient way for me to cover variable DDs without watching my balance too carefully.

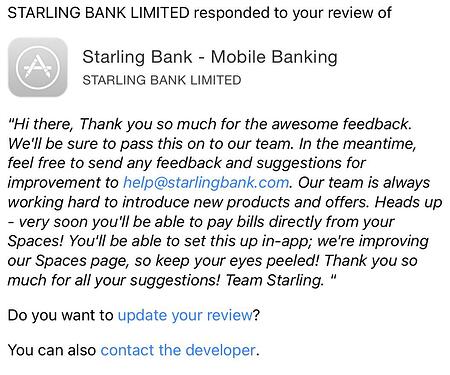

Hopefully it will be released soon can’t understand what is taking them so long but on Twitter they are saying very soon!!

They held off on roundups for a while because they said it was a gimmick. I presume they’ve been resisting this but I think it’s one of their most requested features so have finally given in.

They was probably hoping people would default to taking their second personal account offering instead of bills from spaces to add to their profitability. I mean after all it doesnt cost them to have your main account open so it doesnt cost them any more for the second account. I suppose they see it as a luxury.

Their  is becoming more notorious than Monzo’s

is becoming more notorious than Monzo’s

Just so long as Starling’s “soon” isn’t associated with a £5 or £15 per month commitment…

You don’t need Plus or Premium to pay bills from a Monzo Pot.

Unless it’s a continuous card payment then you do

Ah. They’re all on my Amex card.