Apparently Starling has launched the fixed saver for business customers too

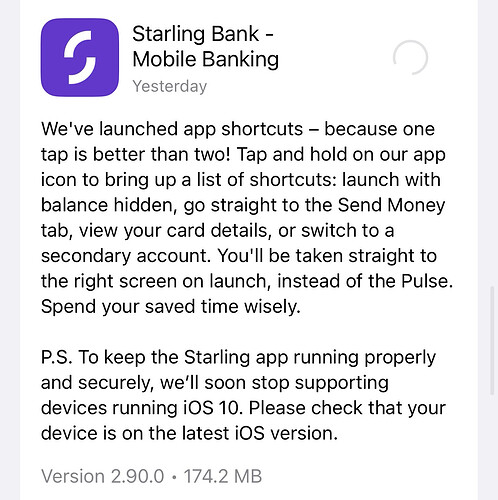

Yes. Got an app update today. Couldn’t find it in the app but not really stopped today to have a proper look.

Anyone else found that round-ups have stopped working? I’ve had a round-up to a “Coin Jar” since the feature was released, but since 14 Feb it’s not rounding up. I raised it with Support and their initial response was that they can see two deposits into my Coin Jar so the issue looks like it’s fixed. I had to point out that these are manual deposits by me and that none of my recent transactions have rounded up… ![]()

The strange thing I’ve found with roundups is that they don’t show in the activity feed of the space they’re going into, but the balance of the pot they are going into seems to be changing. The transaction does show in the detail of the main transaction (under the map where it took place) though.

*edited because sometimes my drafting skills fail me

Roundups all still working for me.

My roundups are working.

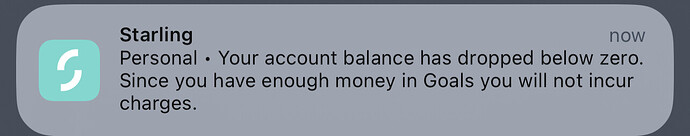

I finally got an answer. They’ve recently changed how it works - 14 Feb as far as I can tell. Now, if your main balance is below zero (even though your account balance including spaces is positive), it won’t round up.

I can see how they came to that change. I can see the pros and cons of (particularly Starling’s uniquely offset) overdraft round–ups.

Personally, I’ve never made use of the round-ups element. I’ve now reached the point of dormancy with Starling because I’ve lost complete interest in their overall package. For me, Chase have filled the gap and I like the Chase App better anyway.

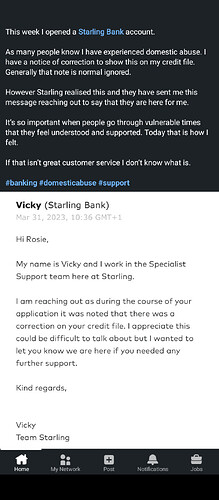

I came across this on LinkedIn and thought I’d share it here. I like Starling for various reasons, but things like this makes them stand out where it matters, even if that’s not banking.

Outstanding customer care.

My experience with Starling resulted in me needing a notice of correction on my file ![]()

On my closed account they randomly updated the address registered to the account - leaving an address I never lived at on my linked addresses. They then insisted this was the address I have registered which I disproved with a statement I fortunately had on an old phone!

Only then did they do the necessary steps with the CRA’s…

At least you’re not experiencing domestic abuse…

Is that a threat? ![]()

I jest,

I’m not making light of the persons scenario - just providing balance - cock ups on a credit file can be incredibly difficult to keep on top of - especially in times of tumult.

It’s good to provide balance when we talk of financial institutions going “above and beyond”

They were dismissive as hell with me and tried to accuse me of entering the wrong address when I signed up (if so, why did you accept me!)

I often find that in the world of consumer finance, normal legal procedure falls by the wayside - often involving you having to prove that you no longer live at the address outlined, or have no association with the person with whom you have been linked - a complete reversal with the laws of natural justice.

Indeed - if I hadn’t saved that old statement I have no doubts from their original tone that they’d have refused to update my records (especially as an ex customer). I have no idea why the address changed to 10 doors down the road - but that address could be associated with serious crime etc for all I knew!

In general, the whole credit file system needs an overhaul. Victims of any kind should be getting protection orders, not notices of correction.

Ok, so my banking with Starling has effectively reached the point of zero use because I almost exclusively use Chase as my everyday account.

This morning I had that message that pops up probably annually, requesting I review my income so that Starling are able to counteract fraud, so yes, I submitted the required info as they claim in their blurb that they have a legal obligation to enquire of their customers what sources of income go into the account.

Anyway, got me thinking ![]() I wonder then, all of those whingers who claim that they’ve had their account shut down for no apparent reason, are the customers basically not playing ball and withholding or lying about how much should be expected to be deposited in their accounts via kosher income sources?

I wonder then, all of those whingers who claim that they’ve had their account shut down for no apparent reason, are the customers basically not playing ball and withholding or lying about how much should be expected to be deposited in their accounts via kosher income sources?

Do Monzo or other banks request or require the information? because I can’t remember the last time Nationwide asked me ![]()