My ahem RBS ahem card also has the new derpy pigeon so it must be a change across the board

I think it’s now clearer what it is. Until the pigeon talk I always thought it was meant to be an eagle!

My ahem RBS ahem card also has the new derpy pigeon so it must be a change across the board

I think it’s now clearer what it is. Until the pigeon talk I always thought it was meant to be an eagle!

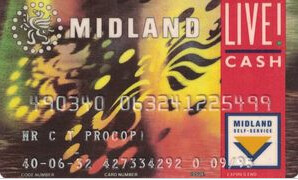

My favourite one was the old Midland Bank Livecash card. Then again, it was my first ever bank account way back in the early 90s and it has fond memories for me.

Interesting! How’s this then…

The new hologram looks very much like a bluish grey Columba livia domestica, with dark tail feathers and wing edges and purple and green accents - the kind you commonly get around towns and cities, as opposed to a white Columba livia domestica which is traditionally used as a symbol of peace.

Here is a quick look at the Level Card (Credit Card) if anyone has heard of them

Credit provided by Lendable. Cards made by Tag System so good quality. Numbers printed on the back but name is still embossed on the front ![]() (I think this is a downside personally)

(I think this is a downside personally)

Front of the Card

Back of the Card

Watch this card, there’s no interest free period so you’re charged from the second a payment is acquired. Shame as the app & card aren’t bad for a credit card!

I’m not sure there @anon22494410 . If the balance is paid in full your not charged any interest. That’s at least the opinion I had.

I have been reducing my credit card usage but really wanted to check the app out and see what it was like

I thought the same, so unless it’s changed since this.

'Hi,

Thanks for getting in touch.

With the Level Card, interest would start to accrue once you have made a purchase on the card and would continue to accrue until the balance had paid off in full.

We wanted to ensure that you were aware of this and happy in the way the card is set up as there are other credit cards in the market where you would not be liable to pay interest if the full balance were to be cleared each month as you mentioned.

Feel free to get in touch with any further questions you may have.

Kind Regards,

Alex

Alex from Level’

If you set it up to pay in full via cpa you’ll soon get an email asking if it’s the credit card for you. Unfortunately lendable are sub prime & act like it, despite the app being alright.

I asked why they do this, they said because they don’t charge people for being over their limit or for spending abroad

Account closed

Edit: I have been using BIP a bit more and it’s really nice to use. They just need to add cash back to rewards to it but it’s aqua so let’s be honest. Barking up a falling down tree

It’s a shame as there’s a breath of fintech choice in the UK current account space, but with credit cards there’s little in the space between big institution & subprime.

Ps Level Card never showed on any cra report, nor did a hard search.

Level card is a bit scummy. I read that they scrapped that daily interest thing. Waste of time aren’t they. That’s a bit naughty doing that.

From Levelcard FAQs

" How is interest charged?

Interest will be charged on your transactions until the time you pay them off.

We will not charge you interest however if you setup your regular monthly payment for statement balance and this payment is successful on your agreed payment date."

Struggling to find an onscreen edition of the actual T&Cs though.

FAQs are useful, however, it is the actual T&Cs that you agree to on sign-up that are legally enforceable.

Well, the above is how all credit cards work, but agree it’s better to read it in the Ts&Cs not the FAQs.

Maybe they changed it. But it was the case back then

Okay so if you pay the monthly amount off in full by the chosen card on the set date. You are all good. There’s nothing different there I always pay my bills in full

They must have changed it. But when I had the card, they emailed me asking if the card was ‘right for me’ as I wanted to pay in full.

When queried he said it had no interest free period. I’m not 100% sure they’d have changed their whole model in 6 months, but who knows

Email them and ask I say

TSB also does a card with no interest-free period, weirdly, but it does have a very low rate for a credit card.

Does anyone know if HSBC have started/when they will start issuing this new design?

They told me end of the year on Twitter

Thank you!

As much as i’ll miss the lion, i find the new design growing on me!